The Ultimate Guide To Home Renovation Loan

The Ultimate Guide To Home Renovation Loan

Blog Article

Home Renovation Loan for Beginners

Table of ContentsSome Of Home Renovation LoanThe Best Strategy To Use For Home Renovation LoanUnknown Facts About Home Renovation Loan6 Simple Techniques For Home Renovation LoanThe smart Trick of Home Renovation Loan That Nobody is Talking About

If you were just considering move-in prepared homes, choosing to acquire and refurbish can enhance the pool of homes offered to you. With the ability to take care of points up or make upgrades, homes that you may have previously passed over currently have possible. Some residences that need upgrades or improvements may also be available at a minimized price when compared to move-in ready homes.This means you can obtain the funds to acquire the home and your intended remodellings all in one financing. This additionally aids you reduce closing prices that would certainly take place if you were getting an acquisition finance and a home equity car loan for the repairs individually. Depending on what restoration program you choose, you might have the ability to enhance your home value and curb charm from renovations while also developing equity in your house.

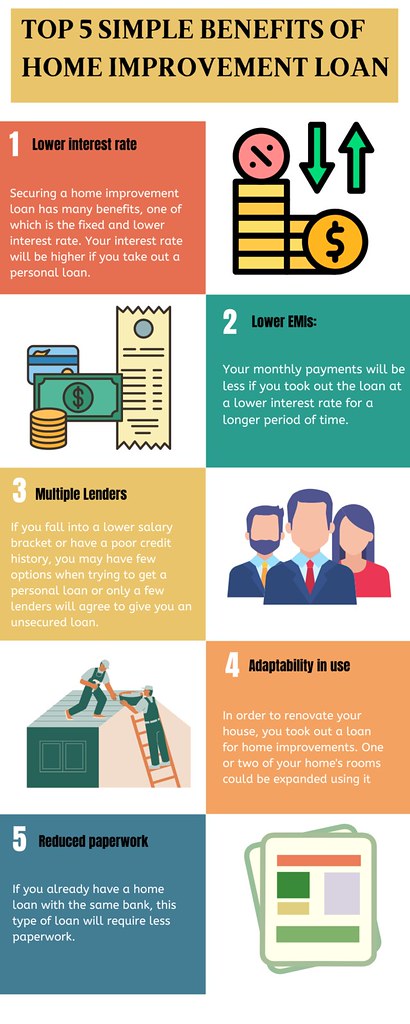

The rates of interest on home remodelling fundings are generally lower than personal fundings, and there will certainly be an EIR, called effective rates of interest, for each improvement funding you take, which is expenses in addition to the base passion price, such as the management cost that a financial institution may charge.

Not known Details About Home Renovation Loan

If you have actually only obtained a minute: A remodelling car loan is a funding remedy that assists you far better manage your cashflow. Its effective rate of interest is lower than other typical financing choices, such as bank card and individual car loan. Whether you have recently bought a new apartment, making your home much more helpful for hybrid-work setups or creating a nursery to invite a brand-new baby, improvement strategies may be on your mind and its time to make your plans a truth.

An improvement financing is suggested just for the funding of renovations of both new and existing homes. home renovation loan. After the finance is approved, a managing fee of 2% of accepted finance quantity and insurance costs of 1% of authorized funding quantity will be payable and deducted from the accepted funding amount.

Following that, the lending will certainly be disbursed to the service providers by means of Cashier's Order(s) (COs). While the maximum variety of COs to be released is 4, any type of additional CO after the initial will certainly incur a cost of S$ 5 and it will certainly be deducted from your marked loan servicing account. On top of that, costs would additionally be incurred in the event of termination, pre-payment and late repayment with the charges revealed in the table listed below.

An Unbiased View of Home Renovation Loan

In addition, site visits would be carried out after the dispensation of the financing to ensure that the financing proceeds are used for the mentioned remodelling functions as noted in the quote. home renovation loan. Really often, remodelling fundings are contrasted to individual loans yet there are some advantages to take out the former if you require a funding especially for home renovations

If a hybrid-work setup has currently become an irreversible feature, it may be great to consider renovating your home to develop a much more work-friendly environment, permitting you to have actually a designated work room. Once again, a remodelling lending could be a useful monetary tool to connect your cash flow void. Nevertheless, remodelling car loans do have an instead strict use plan and it can only be utilized for remodellings which are permanent in nature.

If you find yourself still requiring help to fund your home furnishing, you can occupy a DBS Personal financing or get all set cash with DBS Cashline to pay for them. Among the biggest false impressions regarding improvement funding is the regarded high rates of interest as the released passion price is more than personal loan.

Getting My Home Renovation Loan To Work

Additionally, you stand to delight in a more appealing rate of interest when you make environmentally-conscious decisions with the DBS Eco-aware Improvement Loan. To qualify, all you need to do is to satisfy any type of 6 out of the 10 products that are relevant to you under the "Eco-aware Restoration List" in the application.

Otherwise, the actions are as follows. For Single Applicants (Online Application) Action 1 Prepare the called for files for your restoration finance application: Scanned/ Digital billing or quote signed by professional and candidate(s) Revenue Records Evidence of Possession (Forgoed if improvement is for property under DBS/POSB Home mortgage) HDB or MCST Renovation Authorization (for applicants who are proprietors of the designated contractor) Please keep in mind that each documents dimension ought to not exceed 5MB and appropriate styles are PDF, JPG or JPEG.

Indicators on Home Renovation Loan You Should Know

Implementing home improvements can have various positive results. You can enhance the worth of your building, reduce energy try here costs, and enhance your quality of life. Getting the ideal home improvement can be done by utilizing among the many home improvement fundings that are available to Canadians. Also better, these funding options are available at some of the most effective funding prices.

They supply proprietors personality homes that are central to regional services, supply a multicultural design of life, and are usually in rising markets. The drawback is that much of these homes require upgrading, often to the whole home. To obtain those updates done, it calls for funding. This can be a home equity car loan, home line of credit rating, home refinancing, Full Article or other home financing alternatives that can give the cash required for those revamps.

Home renovations are possible with a home improvement finance or another line of credit scores. These kinds of loans can offer the home owner the capacity to do a number of various things.

Report this page